Introduction - Who Am I?

I am David Nicholls and I am submitting these comments in my personal capacity. I am currently the Chairperson of the South African Nuclear Energy Corporation (NECSA) and was, before I retired, Eskom’s Chief Nuclear Officer, having spent 34 years in Eskom. My experience in the power utility industry is the background to my comments below. During my time in Eskom I spent a significant period of time involved in Eskom’s internal expansion planning process from 1993 to 2016, from when it was called the Generation Expansion Plan, through the Integrated Electricity Plan and finally the Integrated Strategic Electricity Plan.

Of note Eskom disbanded its internal planning process in 2011 as the function was taken by DoE following the publication of the Electricity Regulation on New Generation Capacity in 2009 and the subsequent update in 2011 and all ISEP structures and governance were completely disbanded. Eskom did reestablish the function in late 2013 as an internal process. I stopped being involved in 2016.

Overall View of IRP Approach

The IRP 2023 is split into two Horizons and this is seen as a logical approach. Horizon 1 clearly looks at the currently committed projects and programs and looks at what else should be committed to by 2030. The Horizon 2 looks out beyond that to 2050 and considers five different and independent scenarios. The Horizon 2 section looks at each of the scenarios independently and obviously any actual plant would include a combination of features of several scenarios. This approach seems logical but I would suggest a slight revision. There should be three discrete plans in the final IRP which would complement each other.

Clearly there is an urgent need to resolve the current electricity shortfall in the country and this requires a very short-term plan of up to about 5 years.

There needs to be a long-term vision plan, based upon credible, defendable, assumptions, that meets the need of the South African economy and people as well as meeting the international obligations and constraints in the environmental arena. This plan cannot be based upon the hope that some technology invention will be found that is not currently in place or credibly projected. In line with the Horizon 2 this vision should be in place by 2050.

The third element is the transition plan from the short-term position (fix the current problem) to the long-term vision status.

The transition plan cannot be defined if there is no clarity on the short-term plan and the long-term vision. While each of the three elements should be a distinct plan they clearly interact with each other. For example if the short-term plan is to run the current coal fleet without long-term maintenance but the transition plan expects to extend their operating lives there is a severe mismatch. Similarly if the transition plan is to build HELE coal plants base on an economic life of 50 years, but the 2050 vision has zero carbon emissions then this is not credible as there is not economic case foreseen for an current Carbon Capture and Storage (CCS) technology.

Demand Growth Projections

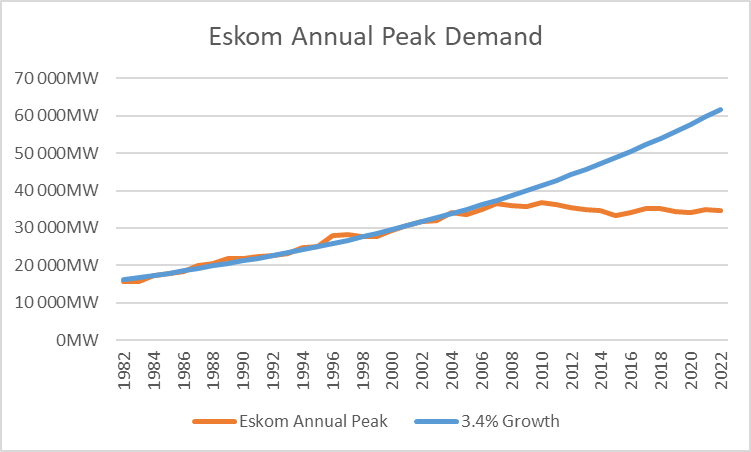

There is one fundamental error I see is in the overall load growth assumptions. Due to the fallout from the 1998 Energy Policy restraints on Eskom’s planned construction program (Lekwe and onwards) the annual electricity generated figures post 2007 show the supply constraint and not the inherent demand. This can be seen from the actual peak demand figures below, compared to the average compound growth curve over the 25 years from 1982 to 2007.

This is supported by the data put out by NERSA in September 2021 (below) which showed the shortfall as calculated by them.

While some may claim this change in load growth is a function of changes in the world economy post the 2008 financial crisis this is only true (according to International Energy Agency – OECD) if you are part of the OECD, for developing countries there is no stagnation in demand.

I therefore propose that the assumption of demand growth based upon the previous 15 years is wholly inappropriate and presumes Soth Africa will be a “failed state”. The national peak (if we had maintained the 1982-2007 profile) would currently be over 65,000MW peak, almost twice our current demand. We need to build a grid to support the economy we need to be, not just maintain our current weak economy.

Basis for Comments

The comments that I have raised below do not try to create an alternative analysis as I have no real doubt that the techniques being applied are very reasonable and in line with best practice. My comments are based upon some weaknesses that I believe exist in the assumptions used by the analysts. Most of these assumptions have been used in previous IRP work and I believe they underestimate the value of the nuclear option to the energy mix. If they were to be used in the final analysis I believe they would significantly alter the preferred outcome as well as showing a lower tariff path.

In particular these are the reasons that I believe there is a mismatch between many of the “least cost solutions” generated by studies that emphasize renewable based solutions and actual world data that shows countries with large renewable programs have higher actual tariffs than comparable countries.

Effective Net Discount Rate used in the Analysis

Discussion on the use of NDR for infrastructure projects

In any capital intensive project, such as a generation asset, the assumed cost of the capital involved is a fundamental element in the cost-benefit analysis. This cost of capital is a combination of the cost of the debt (loans) used to finance it and the expected rate of return wished for the equity injection by the project owners.

This can be expressed as the Net Discount Rate (NDR), the Weighted Average Cost of Capital (WACC), the Internal Rate of Return (IRR) or other expression. All of these relate to the actual annual cost of the capital employed but may relate to only a portion of it. For example the IRR normally refers to the equity portion of the investment using the actual cost of debt for the funding raised by loans. All these are normally expressed as “real” and not “nominal” rates, where nominal is the rate with no consideration of the inflation rate and real is where it is the rate after inflation has been removed.

Clearly if a project is seen as a high risk project and is being financed by private capital then any project based, non-recourse, debt will be expensive and a high rate of equity return will be expected.

If a project is fully state backed, with full and effective sovereign guarantees, then the expected return should be very close to the base sovereign debt level.

This difference is why virtually all infrastructure projects are backed by a government guarantee. In the case of Eskom prior to 1990s it was through the electricity act which required the tariff to cover all Eskom’s costs. In the case of the current REIPPP projects it is explicit sovereign guarantees to cover the political and payment risk (Take-or-Pay PPA contracts). There are very few non-state backed long term infrastructure projects with the most famous one probably being the building of the UK-France Channel Tunnel, where the construction consortium lost all its investment. Even where it appears that long-term projects are funded by “free market” capital it is almost always backed by an implicit support system.

The most common source of loans for large projects is that of Export Credit Agency (ECA) finance. This is a finance package arranged through a national agency that underpins the export of large equipment from that country. The table below is an extract from Eskom’s 2020 Annual Report and shows the loans Eskom had obtained under this process. As can be seen the real interest rates are extremely low, given inflation in US$ and Euros is at a historical 10 year average level of about 2%. This implies the average ECA financing loan at about 1% real, and even those arranged in Rand (by the foreign vendor) is about 3% real, given RSA inflation at 6%.

In the USA the authorized nominal rate of return on equity, which is set by the utility regulator, typically in the range of 9 to 11%, which in real terms is about 7% to 9%. This is, however, the equity portion and the debt element in the U.S. is probably below 2% real for the established utility companies. If one assumes a project debt to equity of 80%:20% this would lead to an overall project NDR of less than 4%. This is aligned with the actual figure being used in the Olkiluoto Nuclear Power Plant Unit 3 in Finland.

Impact of NDR used on Overall Economics

Given the discussion above the method of funding a power plant has a great impact on the NDR to be used in the assessment. In the case of the 5 yearly studies by the Nuclear Energy Agency (NEA) in conjunction with the International Energy Agency (IEA), both of which are branches of the Organization of Economic Cooperation and Development (OECD), use a range of NDRs in their analysis. In the case of the recent reports they use 3%, 7% and 10%. This is to reflect the relevant NDR applicable to fully state backed utilities (3%?), regulated utilities (7%) and a de-regulated utilities (10%). Why this is important in the assessment is the graph below, taken from the WNA.

https://world-nuclear.org/information-library/economic-aspects/economics-of-nuclear-power.aspx

This clearly shows that the choice of a NDR can very clearly impact the selection of a technology. The IRP 2023 uses a NDR of greater than 8%, compared to the 3% the OECD uses for state backed utilities, and Eskom is defined in the 2008 Nuclear Energy Policy and the IRP2019 as the owner operator of nuclear plant. As can be seen from the indicative graph above such a difference in NDR would approximately double the assessed tariff for a nuclear power plant.

Examples of International Analysis

To show the impact of this in an international analysis the LCOE for various technologies and various NDRs is shown from the 2015 study by OECD/NEA/IEA. As can be seen the impact is dramatic, with nuclear being the clear lowest cost at 3% but coal, gas and nuclear being broadly similar at 10%.

Projected Costs of Generating Electricity - 2015 Edition

This study is led by NEA and is undertaken by asking every relevant authority in the world (including South Africa) as to their estimates for the elements for capital and operating costs in their country. These are then used to calculate for each country and region the overall costs of these projects using a standardised methodology. This is then used to create the report. This is where the range and the median shown above is generated. It is probably the most comprehensive such study in the world as it includes all country estimates without any obvious bias by the compilers.

Recommendation

I would recommend that the revision of the IRP includes, at the very least, a range of NDRs in its assessment. I would suggest using 3%, 7% and 10% as per the OECD/NEA/IEA. One could therefore, logically, run the model at 3% showing a state utility costs, 7% as a regulated utility model and 10% as an unregulated model. Alternative one could run the nuclear option only at different NDRs as this is the element of new build. that is specified by policy as remaining in state ownership.

Construction Rate Potential for Nuclear Power Plants

Basis for Assumptions in IRP

It appears that the assumption of the maximum construction rate of large nuclear power plants (PWRs) is a unit per year. Given the most common size of competitive PWRs being built today is about 1200MW this limits the nuclear option in fully replacing the existing coal fleet. It would appear that this is based upon the normal spacing of units on one site (such as the Barakah project in UAE) of one year. While one unit per site per year is the classic approach it is by no means a limit to a national program. When the Nuclear-1 tender was being negotiated by Eskom with Areva and Westinghouse in 2007/8 the contracts with both contractors had a spacing of six months between units on the single site. I have full knowledge of this as I was the technical lead for Eskom’s negotiation team. Clearly a build rate of one unit per site per year is easily obtainable and if there was a serial construction it is logical that Eskom would (as with the 2006 coal station plan Medupi, Kusile, Coal 3 and Coal 4) be able to construct on a number of sites simultaneously, with a new four unit site being started every year. This would result in the following completion profile.

Year 1 - 1 unit

Year 2 - 2 units

Year 3 - 3 units

Year 4 - 4 units

Year 5 - 4 units

Year 6 - 4 units

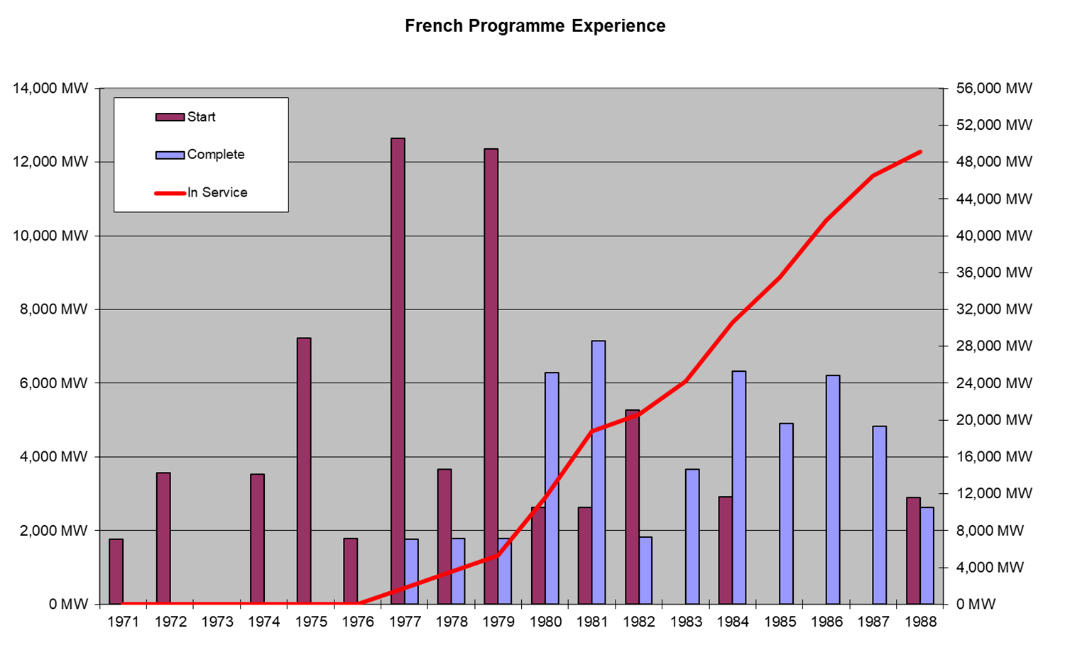

This is aligned with the experience of countries such as France and Seden in the 1970s and 1980s and would result in some 5000MWe per year from year 4 onwards (2038?).

In terms of actual sites Eskom owns three sites (Duynefontein, Thyspunt and Bantamsklip) each of which have the geographic capacity for at least eight units, never mind the option for further coastal sites in the Eastern Cape/KZN border which were excluded from the 1980s site studies due the presence of Transkei and Ciskei (“foreign countries”!).

World Experience for Large Reactors

As a reference of what is possible the above graph shows what was achieve in France from 1971 to 1988. It is notable that pre-1991 France had no experience with large PWRs and virtually all the companies involved in the program had, essentially, to be created (or capacitated) from zero.

Potential for Small Modular Reactors

While the option of SMRs is mentioned in the IRP there is no scenario which includes them. I understand that the assumption for SMRs in the work was one unit per year (100MW?). This is clearly a very conservative assumption. While there is no current reference the PBMR project, when I was its CEO in 1998-2003, had done detailed planning that on a single 8 unit block we would commission one unit every 3 months. It was assumed there could be several blocks on a single site (each 8 x 165MW block was smaller in footprint than a 1300MW EdF PWR).

In the PBMR company business case done by McKinsy in 2002, with the full support of the complete supply chain, it assumed up to 6 x 8-unit blocks being completed per year, or 48 x 165 MW or 8000MW per year. This was not limited by the supply chain but by the market. Clearly this would not be in the first year but the following scale might be more appropriate but still conservative (based on a 100MW SMR?).

Year 1 - 1 unit

Year 2 - 3 units

Year 3 - 6 units

Year 4 - 10 units

Year 5 - 16 units

Year 6 - 16 units

Recommendation

The model limits the construction potential of nuclear plants as noted above and not as currently modelled.

Nuclear Construction Learning Rate for Serial Construction

General World Experience (Russia, China, S Korea etc.)

It is well understood that there is a wide variation in the actual cost of nuclear power stations. At one end of the scale there is some of the “First of a Kind” plants in USA, EU and UK. The quoted total cost of the Vogtle Units 3&4 (Westinghouse AP1000s) project is over $30bn, or $12,500/kWe whereas the Chinese are quoting the new Hualong One twin unit at $2,600/kWe. This difference is not due primarily to lower costs in China but due to the serial nature of the Chinese construction program vs. the one off, first of a class in the US (and EU and UK). If one looks at the basic Bill Of Materials (BOM) for a nuclear plant one gets figures close to that of the Chinese (and Russian, South Korean and Indian) claimed costs. The issue is the “soft” issues, being engineering, nuclear licensing, setting up supply chains, training systems, corporate QA systems, etc. as well as learning on how to construct. These costs can more than double the costs of the first machines as there is no need to repeat for follow on machines, given a standardised design and serial construction.

Norwegian Study of Barakah Project Costs

As specific study into this has been undertaken as part of an overall nuclear economic issues for the Confederation of Norwegian Enterprise (NHO) by Rystad Energy in November 2023. The page from the presentation is shown below (in Norwegian).

The study looked at the costs of the South Korean domestic nuclear program and the costs of the four units of their first export contract to UAE (Barakah NPP). This shows the low domestic costs (aligned with the Chinese costs discussed above) as well as the cost evolution over the four units of Barakah, being respectively 255%, 200%, 143% and 108% of the South Korean domestic equivalent. These results align with many, less rigorous, reviews of export contracts as well as Eskom’s experience in building “6 pack” coal stations where unit 1 was far more difficult than unit 3 onwards on all of them. It most be noted that the upfront costs in the UAE were somewhat higher than would be expected in RSA as they had no prior nuclear experience and related structures (e.g. NNR) and also it was Sout Korea’s first export and they had much to learn. This impact of serial construction is not modelled in the IRP 2023 (or previous ones) has a very major impact on nuclear viability.

Recommendation

It is recommended that the domestic serial learning be modelled in the nuclear build as a function of Unit 1 costs.

Unit 1 - 100%

Unit 2 - 80%

Unit 3 - 60%

Unit 4 - 50%

Unit 5 - 50%

Unit 6- 50%

Infrastructure Costs Impact on Scenarios

Key Infrastructure Expansion Assumptions in IRP

The IRP appears to assume that the infrastructure costs are not charged to individual generation plants but to the overall “system”. There are two sets of infrastructure that are relevant to the IRP studies – these being the transmission grid expansion and the gas reticulation system.

The current public quoted assumption on the transmission grid expansion are 14,000km of HV lines with an associated cost of some R390bn. This expansion is both massive and totally linked to the expansion of the renewable energy sector. In terms of scope it appears to be a 50% increase in RSA total grid system and needs to be installed at a rate higher than ever achieved in history. There are statements that it is ten times the rate of installation over the last ten years. The needs for this expansion is linked to the “need” to provide access to intermittent renewable energy sources distributed over the country.

There appears to be no specific costs or scope assigned to the gas reticulation and storage systems and it would heavily depend on the load factor and location of the related gas-to-power plants. It is notable that the historical South African experience of installing gas pipelines (both the Multi-Purpose Product Pipeline (NMPP) for Transnet from Durban to Gauteng and the Mozambique-Secunda for Sasol) indicate the long timelines and costs involved in such projects. Clearly if there is to be gas used as a power source to support renewable energy systems through weather related shortages there will need to be significant gas storage systems for which costs will be required, covered by some form of payment by the overall system operator?

Cost Allocation of Infrastructure Capex & Opex

The current IRP analysis does not appear to account for these costs. It is therefore considered that the renewable options should, at the least, consider the extra costs and deployment time required for the transmission infrastructure expansion as well as allocation of the related operating and maintenance costs.

Similarly the gas-to-power projects should include the costs incurred for the related infrastructure. It is notable that recent comments by private sector proponents of gas supply industry have called upon the state to provide guarantees of long-term gas offtake contracts to justify the establishment of the gas supply and reticulation infrastructure to allow the “commercial” use of gas.

Options to limit Infrastructure development needs

The IRP does not currently consider significant, rapid, growth in electrical demand and therefore if the current generating sites (Eskom coal stations) were in fact repurposed to provide similar dispatchable electrical power (new coal, gas, nuclear) into the grid then the grid expansion would not be significant. This approach would also limit the site development requirements for these new plants (grid access, transport links, staff accommodation, water supply etc.) which is a significant portion of new plant costs on a green field site. The sustained economic activity would also support the socio-economic aspects of a Just Energy Transition.

Recommendation

It is therefore recommended that the IRP should include the related transmission expansion costs (in the order of R390bn) in the scenarios that relate to a large expansion of renewable energy options and that an analysis of the gas infrastructure costs (including storage systems) be included with the various gas-to-power options. The gas-to-power options must include credible assessment of the load factor and gas storage required along with the impact of such criteria on the relevant sovereign guarantees/PPAs.

In both cases the timeline for the option should consider the infrastructure development issues, given current South African experience.

Proposed Option for Current Crisis, Long-term Position and Transition

In light of my review of the IRP and the comments above I would propose that the way forward for South Africa’s electricity system can be seen as having four elements:-

In the short-term the management and funding of Eskom has to provide a recovery of the plant availability of the current fleet to levels more aligned with international experience with units of their age, being 70+% as well as life extension were feasible.

In the medium-term the country should proceed with a roll out of natural gas fired Combined-Cycle Gas Turbine (CCGT), either on the coast or close to current gas pipelines. This would be linked to establishing a LNG terminal on the Mozambique end of the current “Sasol” gas pipeline.

In the long-term, to meet viable and economic net-zero carbon generation targets, to build a nuclear fleet of standardised and serial construction. This fleet could consist of two legs, one being large PWR units on coastal sites (Koeberg, Thyspunt, a new site on the Eastern Cape/KZN border) and the other Small Modular Reactors on the existing Eskom coal units sites in Mpumalanga.

The fourth elements is allowing private sector (both residential and industrial) to expand the small embedded generation systems and also to have non-regulated IPPs with direct customer contracts wheeling through the transmission system. For this to be economically effective the tariff structure for those customers who are not sole suppled by the national system would need to correctly reflect the cost elements. This would imply a much higher connection fee and a time-of-use energy tariff.

While the timeline of each of these options is different the lead times require all to be committed to with urgency.