Lazard's "error" in the cost of nuclear

A lesson from Albert Einstein

Albert Einstein once said that, "Compound interest is the eighth wonder of the world," but it appears that critics of nuclear power may not have fully grasped how this lesson applies to a technology that depends on the equation E = mc2.

I came across an article on the cost of nuclear power published on the website MyBroadband, where the Credit Agency Lazard was referenced regarding the cost of nuclear power, stating that it would be expensive in South Africa.

“Lazard, which is a very authoritative source on finance and infrastructure matters globally and is the transaction advisor to Eskom, has estimated that nuclear at the moment is between $141 and $221 per MWh.”

Lazard, though a recognized source on finance and infrastructure matters globally and serving as the transaction advisor to Eskom, is not always regarded as a definitive authority by industry experts, in particular to those in the nuclear industry. This is due to notable contradictions with international benchmarking standards and audited accounts.

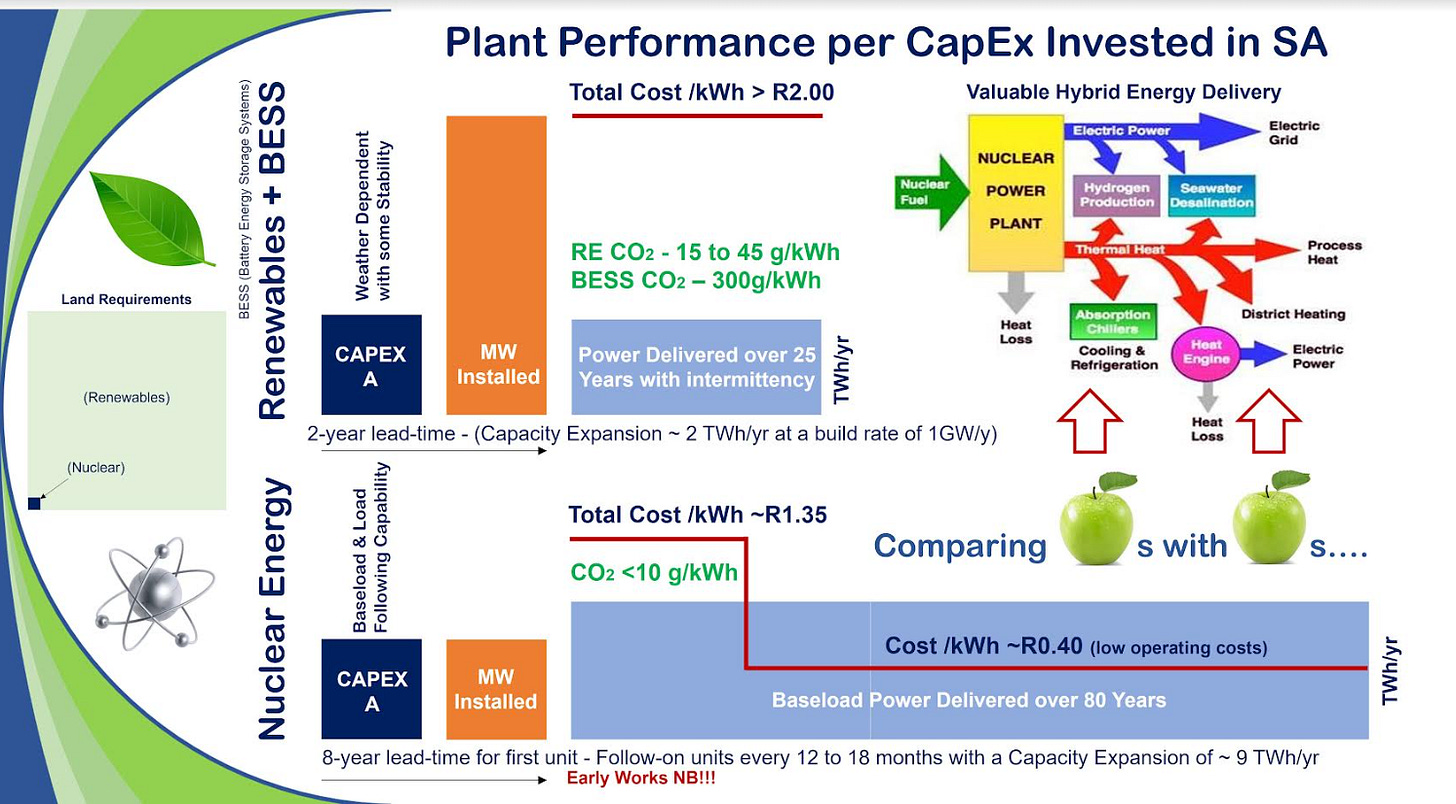

The purpose of the study was to compare these figures with "alternative energy technologies", particularly wind and solar PV, but without taking account of system costs. The nuclear costs estimated by Lazard were well above those in the IEA-NEA study based on existing projects, with well-referenced data.

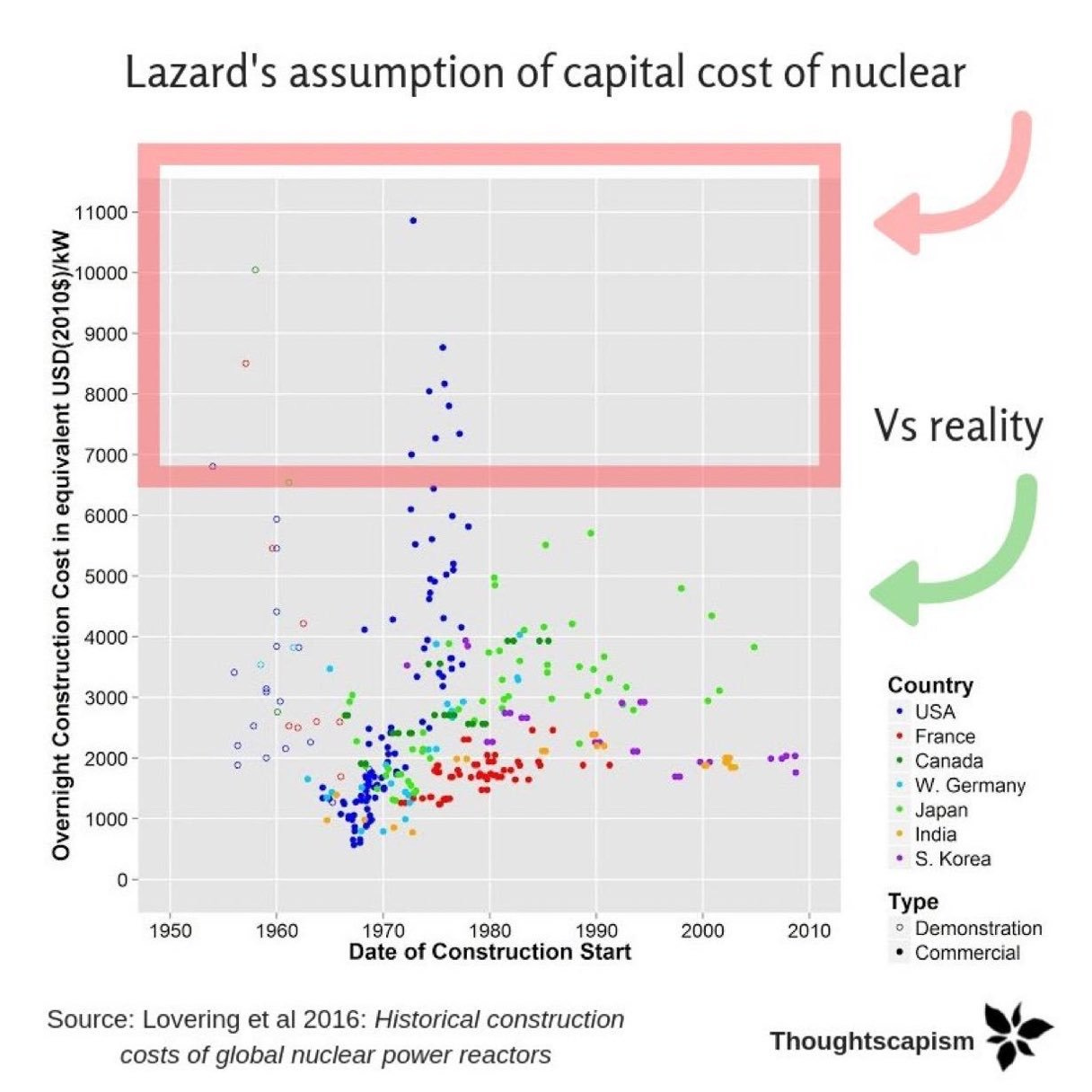

Lazard makes a few obvious errors, a notable error in the capital expenditure of nuclear power as shown in the graph below.

To provide a more comprehensive perspective, I suggest consulting a report titled "The Cost Drivers of Nuclear Power," that was prepared by a UK Government Task force for the UK Industrial Strategy and Clean Growth Strategy.

Lazards data seems to predominantly focus on costs in France and the United States and ignores the more affordable nuclear power costs in other regions worldwide.

The ETI Nuclear Cost Drivers Project Summary Report highlights that nuclear power costs are primarily influenced by capital expenditure, with Eastern countries such as Russia, Japan, China, and South Korea demonstrating more cost-effective outcomes.

The validity of the levelized cost of electricity remains a subject of intense debate. Nevertheless, considering the figures provided by Lazard, it's worth noting that the cost of nuclear power could be significantly lower than that, potentially falling below $50/MWh, if bought from the correct country.

This places nuclear power below the costs associated with firming solar and wind power, as per Lazard's own data.

It’s crucial to recognize that if South Africa decides to construct a nuclear plant, financing options such as export credit agencies or national banks could offer lower interest rates (often below 2%).

The figure below shows the current rates that South Africa can get from export credit agencies, based on Eskom’s 2020 financial report.

Therefore, even with cost overruns, it’s implausible to achieve the higher costs cited in the article.

Below is a tool that shows the error by comparing the cost of Nuclear Plants in the United States, the UK and France (at an 8% return on capital) with that of South Africa (at less than 2%).

With just a basic understanding of how compound interest works, we can easily see why nuclear power is completely affordable to South Africa, and why it remains the most affordable source as per Eskom’s Balance Sheet.

There simply isn’t a better deal than another Koeberg.